Edge #8 - Crypto and Hypocrisy

What I read

Relentless - 12 Rounds to Success, boxing promoter Eddie Hearn’s autobiography, is a refreshing read. Most people know him as a flamboyant and outspoken character. In the book, he’s very open about being born in privilege as the son of Barry Hearn, who founded Matchroom and was a famous sports promoter in his own right.

In each chapter (or round), Eddie highlights a life lesson through his journey. It’s an entertaining and easy to read book. I would recommend it even to those with no interest in boxing.

Resource of the Week

The holiday season is here. Personally, I haven’t left the UK since COVID, but for those lucky enough to get away this summer, I recommend Revolut. I’ve been using this for a few years now. It gives you the option to make foreign currency exchanges at great rates directly in the app.

There’s a whole host of nifty features like creating one-time disposable virtual credit cards that won’t work after one use to prevent fraud. Also, you can invest in stocks and crypto direct in the app if you choose. If you sign up using this link, we both get £50. Take a look.

Quote

Don’t let the noise of others’ opinions drown out your own inner voice.

Steve Jobs

Thoughts

It’s been an eventful week in the crypto world. Despite being a crypto investor for a similar time to property, I’ve always been very wary when talking about crypto. It’s been with us for a long time, but it's still the wild west in the grand scheme of things. Cowboys are everywhere. I don’t just mean kids on social media with rented Lambos, but people in positions of power.

I remember distinctly in 2017, Jamie Dimon, head of JP Morgan, called Bitcoin a ‘fraud’ and ‘would fire any trader trading Bitcoin for it being stupid’. It was a clear tactic (in hindsight) to manipulate the market while he was making acquisitions himself on behalf of clients. The hypocrisy really opened my eyes and pissed me off at the time. I learnt that it was a dog eat dog world out there. It worked, causing a mostly unsophisticated investor market to get spooked and panic, which basically gave Jamie a nice discount.

There are many unknowns for this immature market, but one true thing is that crypto is here to stay. In these times, it’s essential to drown out all the noise. Stop speculating on what the price will do next. Look at the fundamentals. What has changed? Let’s look at some of the reasons for this most recent sell off:

- Rising central bank interest rates restricting credit.

- Rise in cost of living reducing disposable income for risk assets.

- The disruption caused by the war in Ukraine. People with Russian banks having their funds and assets being frozen.

- Coinbase reporting massive losses and possibly going bankrupt, warning investors they may lose their funds stored on the exchange.

Not a single one of these is an adverse change in the fundamental role of Cryptoassets. Having said that, as I say in property:

- You make your money on the purchase, so don’t overpay. Zoom out as far as you can. Don’t get carried away.

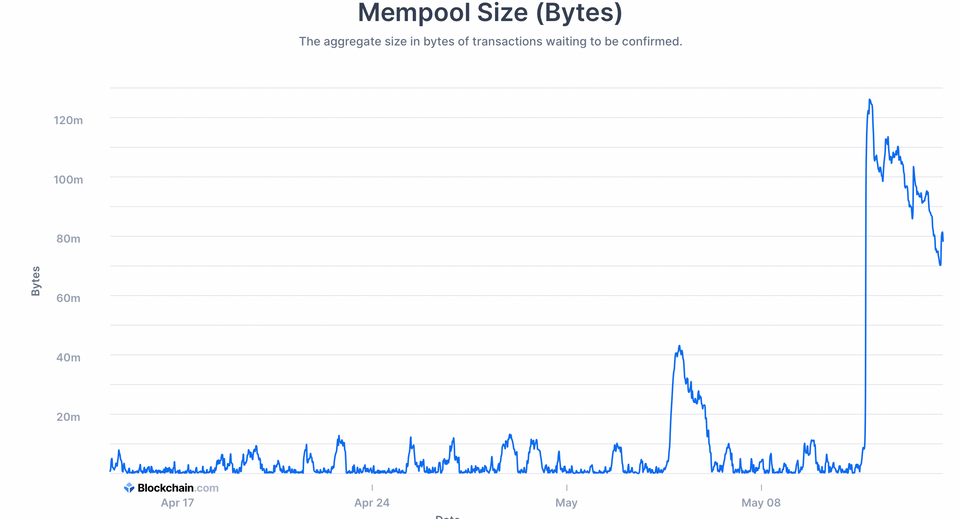

Here we have a Mempool chart, which is a list of all valid transactions waiting to be confirmed on the blockchain. As you can see, there’s been a massive spike in activity and it continues to be high. Personally, I’m keeping a firm eye but not investing right now.

Regulation is still playing catchup. There’s a vast amount of potential as we’re now in this phase of crypto where it’s still immature, but institutions have started taking it seriously (JP Morgan has their own crypto division now, who would’ve thought!).

More importantly, trust no one when it comes to investing. Nothing beats doing your own due diligence.

As always, thanks for reading. Just reply if you have any questions, feedback, thoughts, or if you disagree with me (those are my favourite). Have a great weekend.

Hans