#84 - Where is the property market and where is it going according to the experts?

What I’m Watching

I’ve been watching some sad films as of late.

Still Alice is about the journey of a talented linguistics professor getting diagnosed with early-onset Alzheimer's disease and the effect it has on her life and those around her as she deteriorates.

My Life Without Me is about a young mother getting told she has terminal cancer and how she goes about doing things she never got to experience while not telling anyone about her diagnosis. I quite like it, if you need more reason to watch (or not!) the Hulk and Doc Ock are in it.

Spoiler, they’re both very sad films, but I enjoyed them both.

Resource of the week

If you’re thinking about starting a social media journey, it’s almost a must to have an email list to supplement it. Even today, with the numerous social media platforms out there, an email list is the only one where you truly own your audience. It means that you’re not at the mercy of an algorithm for your audience to see your content and you can be sure it’ll be delivered. I’ve used Convertkit since the beginning and I’m still happy.

Quote

“We learn nothing by being right.”

From the James Clear blog: Actress Elizabeth Bibesco on the importance of failure

News and trends

- The renters’ reform bill had its second reading earlier this week and the headline from it is that the ban on S21 (or what the media likes to call ‘no fault evictions’) has been delayed.

- Foreign investment into London property is no new thing, but it looks high net worth investors in the Gulf states are now looking towards the North: Manchester, Liverpool for their next investments.

- Teachable has released a report stating that the majority of consumers only meaningfully engage with 1-5 creators. Also, 40% of consumers stated that their decision to buy products is from a sincere desire to support the creator.

- The battle of social media platforms heats up as TikTok trials 15-minute videos in an effort to compete with YouTube. Personally, I don’t think this will work due to the nature of the app and the audience. I use TikTok a lot for certain types of content will still default to YouTube.

Thoughts

So, I was at the National Residential Landlord Association conference this week, it was particularly insightful due to the current uncertain economic backdrop, particularly in the private rented sector. The secretary of state, Michael Gove made an appearance and he was given some uncomfortable questions which was interesting. We had presentations from the head of research at Savills, the executive director at Zoopla, and a lot more so here is the breakdown:

Current snapshot

- Bank of England base rate held at 5.25% after 14 base rate rises.

- Inflation falling but wage growth remains high.

- Average house price movement in the year to September is at -5.3%.

- August mortgage approvals -10% on the preceding 6-month average

- Rental growth at 10.5% (record highs) due to an underlying supply-demand imbalance.

- New house building falling.

Market trends

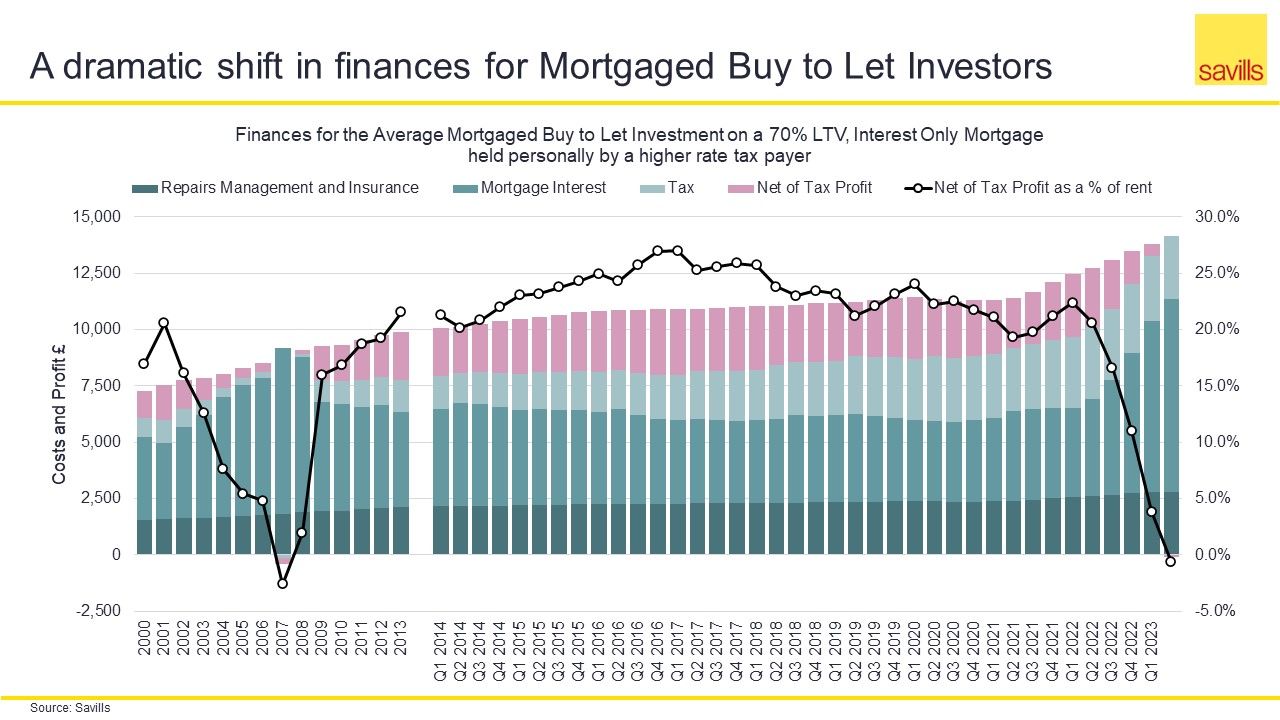

- Landlords are exiting the market, supply has been static since around 2015 during which demand has grown. This is mainly due to higher borrowing costs for landlords and the ageing landlord population with 70% of private landlords being over 55 years old.

- Of course, this trend is not spread evenly across the country: 50% of all landlords selling are based in London and the South East which will feel the rental crisis the sharpest in the coming years.

- Increasing trend of the sector professionalising, meaning that smaller ‘accidental landlords’ that own one of two properties will make up the bulk of those exiting. Currently, around 18% of landlords own 50% of properties.

- Surveys reveal a shift from the high-leverage growth model to one more focused on cash flow.

Future Outlook

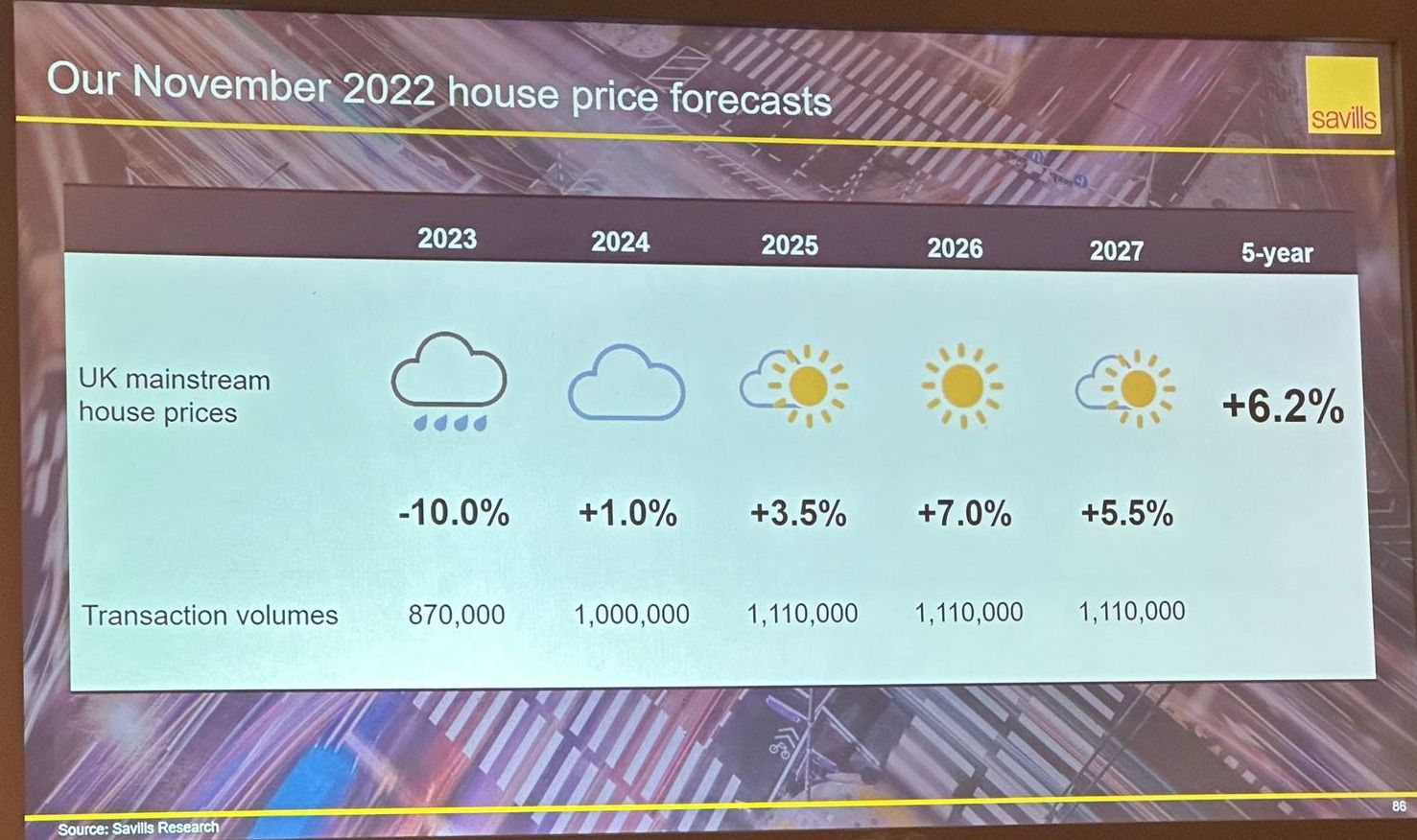

- According to Zoopla, it looks like we are entering an era of low growth.

- The shift to more focus on cashflow will mean segments such as HMOs and holiday lets could potentially see growth.

- While the landscape has changed the fundamentals remain the same.

- Going forward it’s expected we’ll see slow growth next year but not a recession. Similarly, the property market is expected to see a gradual rebalancing.

- While affordability is hit, the market is insulated from a major crash due to stress testing and homeowners having high levels of equity.

Forecasts

- Inflation to fall to 4.6% in Q4 2023 - CPI (Oxford Economics)

- Base rate to peak at 5.5% or 5.25% (Oxford Economics)

- CPI inflation to end next year at 2.5% (Oxford Economics)

- 2 x 0.25% Bank of England base rate cuts in the second half of 2024 (Oxford Economics)

- Weak economic growth but no recession in 2024 (Oxford Economics)

Overall there was nothing groundbreaking here but it was good to hear a more balanced view than media portrayals. It was interesting to hear that Michael Gove was unambiguously against rent controls as they have been proven time and again to not work. Someone in the audience asked a great question which was ‘why is there so much emphasis on legislation and almost none on enforcement, surely this unfairly penalises the good landlords?’ It’s something I agree with, take local landlord licensing schemes, which only seem to police people who sign up which is pointless as the rogue landlords are the ones who don’t bother. Gove’s answer was unconvincing to me, he said we have to have a clear set of rules before anything can be enforced.

Clearly, there are still a lot of issues the PRS faces but what’s also clear is that claims that BTL is dead are untrue, the game has changed and it’s about adapting.

What do you think about all of this? Hit reply and let me know, I read all responses.

Otherwise, have a good week!

Hans